The housing market has been adjusting since the Fed increased the interest rate for the first time about a year ago. Homebuyers have, begrudgingly, become accustomed to the current rates, which remain historically low. The housing inventory also remains low. The housing market in the spring of 2023 is comprised primarily of serious buyers and sellers.

All real estate is local. This article focuses on the real estate market in Western Washington, more specifically, the Eastside. Several factors govern the direction in which the housing market might move. We will discuss two fundamental aspects.

Interest Rates and our housing market

Some home buyers are moving ahead with their purchases, hoping they can refinance at lower rates at some point in the future. A decline in interest rates is a distinct possibility at some point, there is neither a guarantee that it will occur nor there is a way to pin down when. If we are to be guided by history, it will be three to five years before the interest rates reverse course.

As the rates have risen, the activity in real estate transactions has steadily declined over the last year. This, however, has not caused any significant reduction in home prices, which have remained steady or increased, albeit less than in previous years.

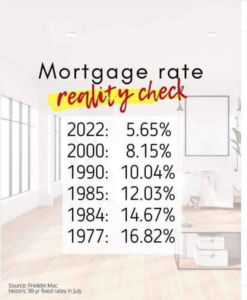

The interest rates have increased substantially compared to the last few years, but historically they remain low.

The most recent NWMLS report shows that at the end of February 2023, there were only 1.7 months of supply across 26 counties. That’s an improvement from a year ago when there were only about 0.7 months of supply (about three weeks); it is down from January’s total of about 2.5 months.

Based on February’s closed sales, the median price was $575,000, down 1.7% from the same month a year ago but up 3.1% from January 2023. Year-over-year sales prices slipped in all but six counties. YOY asking prices were unchanged areawide, at $650,000, but vary widely by area. NWMLS records show that the last time year-to-year prices fell was from March 2011 to March 2012.

The numbers for the housing market in spring 2023

NWMLS data for the tri-county area (King, Pierce, and Snohomish counties), where about half the current inventory is, show the asking price of more than seven of every ten listings (71.6%) to be $600,000 or more. Nearly a third (31.6%) have an asking price of $1 million or higher.

About 18% of the homes and condos sold last month in the King-Pierce-Snohomish region sold for at least $1 million. The activity in the luxury market remains robust and shows strong buyer demand.

New listings, pending sales, and closed sales were all up from January 2023. These are clear indications of a typical seasonal market.

Potential homebuyers waiting for a significant drop in home prices will likely be disappointed. Always do your research, and buy within your affordability range and in an area that will likely remain unaffected by minor economic fluctuations.

Housing Inventory

The number of homes available for sale in (the housing inventory) is an essential factor in how the housing market in spring 2023 will move. The economy continues to be pulled in all directions by high inflation, increasing interest rates, ongoing geopolitical uncertainties, and recession fears, to name a few–––and yet, the housing supply remains limited.

Those who purchased homes in recent years and have mortgages at record-low interest rates are inclined to stay put. Sellers are worried about finding a replacement home and are reluctant to give up their 3% and 4% mortgages. New home construction is also down due to various factors. Home prices, while less meteoric than in recent years, remain high year-over-year.

Single-family construction starts in January were down 4.3% from December, and applications for building permits declined by 1.8% from the previous month, according to preliminary data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

There are no indications that the housing inventory will improve soon. Interest rates will be the driving factor for home prices in the foreseeable future.

In conclusion

As expected, different housing-related industries put their spin on the available data. The most recent data (you can read current and recent monthly reports here) indicates that the housing market in spring 2023 and beyond will be less active, but the prices will continue to rise, albeit at a lower pace than in the last three to four years.

If you are a potential home buyer waiting for a considerable drop in the market, that is highly unlikely to occur. Interest rates are stabilizing. If you can find the house you want and can afford, buy it.

If you are a potential home seller, either to move up or to sell for any reason, price your home reasonably, and you’ll be well rewarded.

Due to the recent meteoric rise in home prices, people have started to view their residences as an investment first and a home second. That is not accurate. We all need a place to live. We buy homes because we want to live in them. If there is a financial gain to be had in the long run, that’s wonderful.

If you have questions about your specific situation, please reach out. We will get you the answers.

Comments (0)