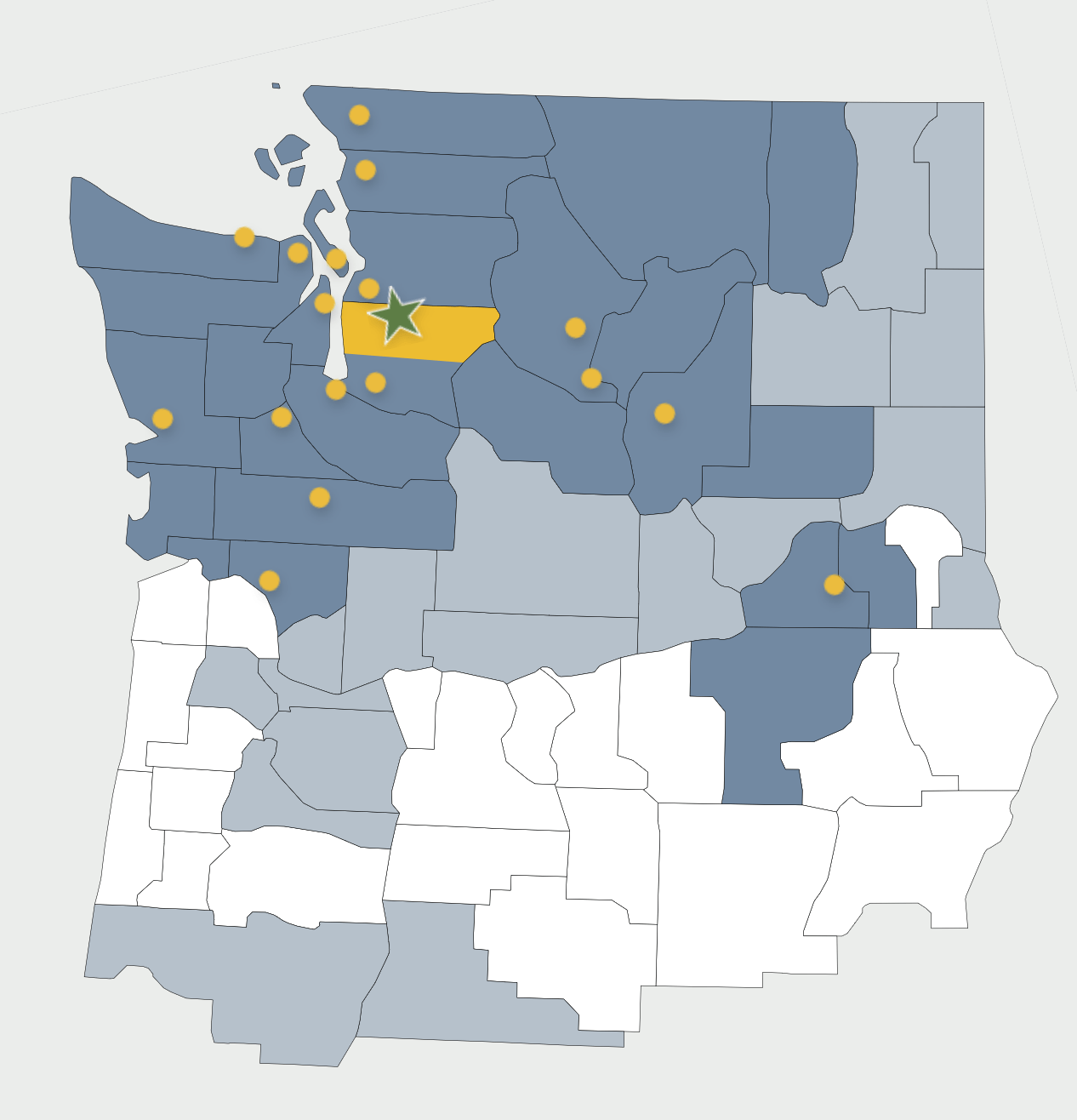

Northwest MLS just released its Annual Report on sales and listing activity for 2023 within the 26 counties it covers in Western Washington. As the old saying goes, all real estate is local. This article contains numbers about the 2023 housing market in Western Washington only. An accurate market snapshot will help you stay better informed. Whether buying or considering putting your home on the market, the most essential tool is current, accurate, and relevant information. We provide you with this information every month. This article is the annual review for 2023, based on the numbers supplied by NWMLS. You will find crucial information in these most current real estate stats. If you need specific information about your neighborhood or the one you may be considering living in and don’t see it here, reach out, and we will get it for you.

Sales Recap

Sixty-four thousand two hundred eight residential homes and condominium sales took place in 2023, valued at over $48 billion. Nearly 87% of these were residential homes. Condominiums made up the approximate remaining 13%.

These numbers represent a significant drop of 23.6% or 19,829 fewer sales, compared with 2022. This drop is the second year-over-year decrease in sales since the record highs of 2021.

Home Pricing during 2023 in Western Washington

$600,000 was the median price for last year’s completed transactions, a decrease of 2.44% from 2022’s figure of $615,000. The median price ten years ago, in 2013, was $270,000. It is important to note that 2013 was the tail end of the housing crisis resulting from the collapse of the mortgage industry in 2009.

Both residential home and condominium median prices decreased year-over-year, with residential homes decreasing 2.04% from 2022 and condominiums decreasing 1.69%.

The residential median home price of $625,000 was $13,000 less than the 2022 median price of $638,000, a 2.04% decrease. Condominium median prices decreased by 1.69% from $473,000 in 2022 to $465,000 in 2023. Median prices in King, Pierce, and Snohomish counties decreased in 2023 by 2.47%, 3.67%, and 4.11%, respectively.

Factors affecting these numbers

Simply put, the primary driver on a downward trend in 2023 Housing Market in Western Washington is the high mortgage lending rates with a two-pronged impact. First, the lending rates have priced out many homebuyers because of a rapid climb to almost doubling. Second, homeowners whose current mortgages are in the 2 and 3 percent range are unwilling to sell their homes, resulting in an inventory crunch.

Listing Activity

Eighty-one thousand six hundred twelve new listings came on the market during 2023, down from the previous year’s volume of 110,294, a significant drop of 26.01% of available inventory.

On average, there were 9,579 active listings in the NWMLS database each month in 2023, a nearly 5% decrease from 2022’s average of 10,075.

What about 2024?

There is no evidence that the mortgage lending rates, currently at 7.89%, will come down shortly. Even if the Fed eases a bit during 2024 (not very likely), the mortgage rates are not expected to get any lower than between 5.5% and 6%, still significantly higher than twelve to eighteen months ago. That means the abovementioned factors will remain the same, and you can expect another downward-trending housing market in Western Washington. Current homeowners who are aptly not eager to sell their homes because they have mortgages well under 4%, some even less than 3%, will remain a significant factor in inventory shortage for some time.