How robust is Seattle’s real estate market? Consider these recent stats.

- The median sale price of a home in Seattle rose by 26.1% from the previous year. It was $737,800 at the end of May 2021.

- Almost seventy percent of properties in the Greater Seattle area sold for considerably higher than the asking price.

- On average, it took only five days to sell a house.

- The median listing price of a home was $765,000, and the median sale price was $856,800.

Is that robust enough?

However, this chaotic real estate market has softened a bit in recent weeks. It is taking a little longer for a house to sell. There are also more price reductions. BTW, we now use more exotic words like refreshed pricing or improved price rather than a good old price reduction.

Is buyer fatigue playing a part?

The short answer is yes! I previously wrote about challenges faced by home sellers in this real estate market. But that is nothing compared to what homebuyers have had to face recently.

The realities of this chaotic yet robust real estate market have compelled homebuyers to make offers well beyond their initial price point. It became commonplace to offer ten to fifteen percent above the asking price, waive crucial contingencies, and bow to the whims of the sellers. It has been challenging for buyers in recent years to purchase a home. After repeatedly going through the tedious process of deciding which home to buy, it can be extremely disheartening to make an offer only to have it rejected.

I vehemently oppose waiving protections afforded to home buyers in Washington State. I wrote about it in detail in a previous article. You can read that here. The goal of owning your home is vital for many reasons––personal lifestyle, children’s education, and long-term investment. It is imperative to exercise sound judgment when making this acquisition. Potential homebuyers will find beneficial information here.

There is not only buyer fatigue but also buyer agent fatigue.

A buyer’s agent is a real estate agent who works exclusively with home buyers. Our chaotic seller’s market has been very challenging for these folks, as well. They show homes and prepare multiple offers for the same client over and over again. As time goes on and the buyers cannot acquire the house of their choice, they become frustrated and even more demanding. This frustration flows to their agents.

Most newer brokers tend to work with buyers only. Some lack experience and are eager to make a sale. They encourage their clients to take a do whatever it takes to buy a house approach. Sadly, this mindset is not limited to newer brokers only.

Here is a real-life example of a recent transaction. A new listing priced at close to one million dollars in one of the most desirable areas came on the market. It had more than sixty showings over three days. On the offer review date, it received only one offer. That one offer was more than one hundred thousand dollars above the asking price from an out-of-town buyer who had not even seen the house. This particular buyer relied entirely on the broker’s recommendation. Based on the showing activity, without having a single conversation with the listing broker, this experienced buyer’s agent assumed several offers for that house and had their client offer thirteen percent more than the list price. So, yes, buyer agents contribute substantially to this chaos in our current market.

This broker would have served their client better by making use of the escalation clause. I will write about that in a separate article.

What to expect?

I have been in the business long enough to know better than to make predictions. There is some anxiety about our real estate market. People wonder what happens when the rental moratorium ends and when the forbearance agreements put in place due to the pandemic become due. There are valid questions.

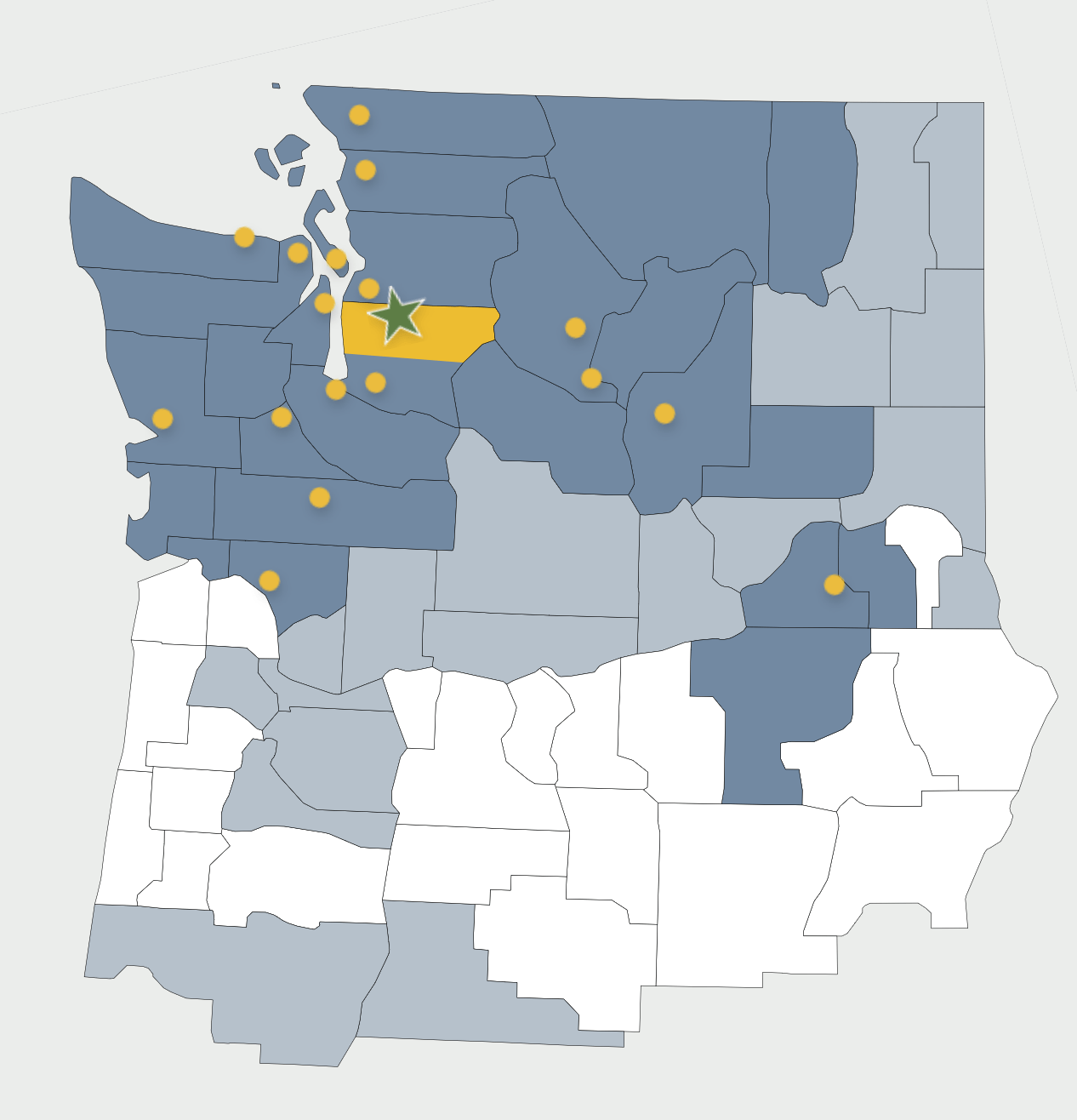

Based on the data, it is reasonable to expect that the real estate market in our State will remain robust for the foreseeable future. There will be periods of vigorous activity sprinkled with cooling-off periods.

Here is the information that is the basis of my assessment. These stats are about the mortgage forbearance agreements status as of July 2021.

- 44.1% have paid their arrears in full.

- 38.7% have agreed upon a repayment plan with their lenders.

- 17.2% remain unpaid and without any arrangement to repay. This group is most likely to hit the market in shortfalls and foreclosures.

Between 2006 and 2013, 9,500,000 homes went into foreclosure. In 2021 only 1,900,000 are in that danger––a significant number, under different economic conditions and significantly higher home prices.

Prudent home buyers and sellers understand the need for having a seasoned and knowledgeable broker represent them in their real estate market transactions. Are you thinking about selling your home? Consider our seller services here.