The current real estate housing market has been transitioning to a buyer’s market since about May 2022. At the same time, due to mortgage lending rates climbing high and quickly, it has squeezed out the essential segment of home buyers. In 2021, one could buy a house worth $759,000 with 20% down and a monthly payment of $2500.00. Now, that monthly payment will get you a house worth $476,000.

Entry-level homebuyers are the backbone of the real estate housing market.

In the greater Seattle area, a house that costs about $500,000 is considered entry-level. Often these are small, older homes with two or three bedrooms, within thirty minutes to more than an hour’s driving time from Seattle or the East Side.

If you were looking to buy a home in this price range earlier this year with a budget of about $2,000 per month, you couldn’t find a home in that price range. However, in September 2022, the inventory almost doubled. But now, to buy that $500,000 house, you need well over $3000 per month––and if that is beyond your budget, you simply cannot do it.

Home sellers have not yet fully grasped the real estate housing market shift.

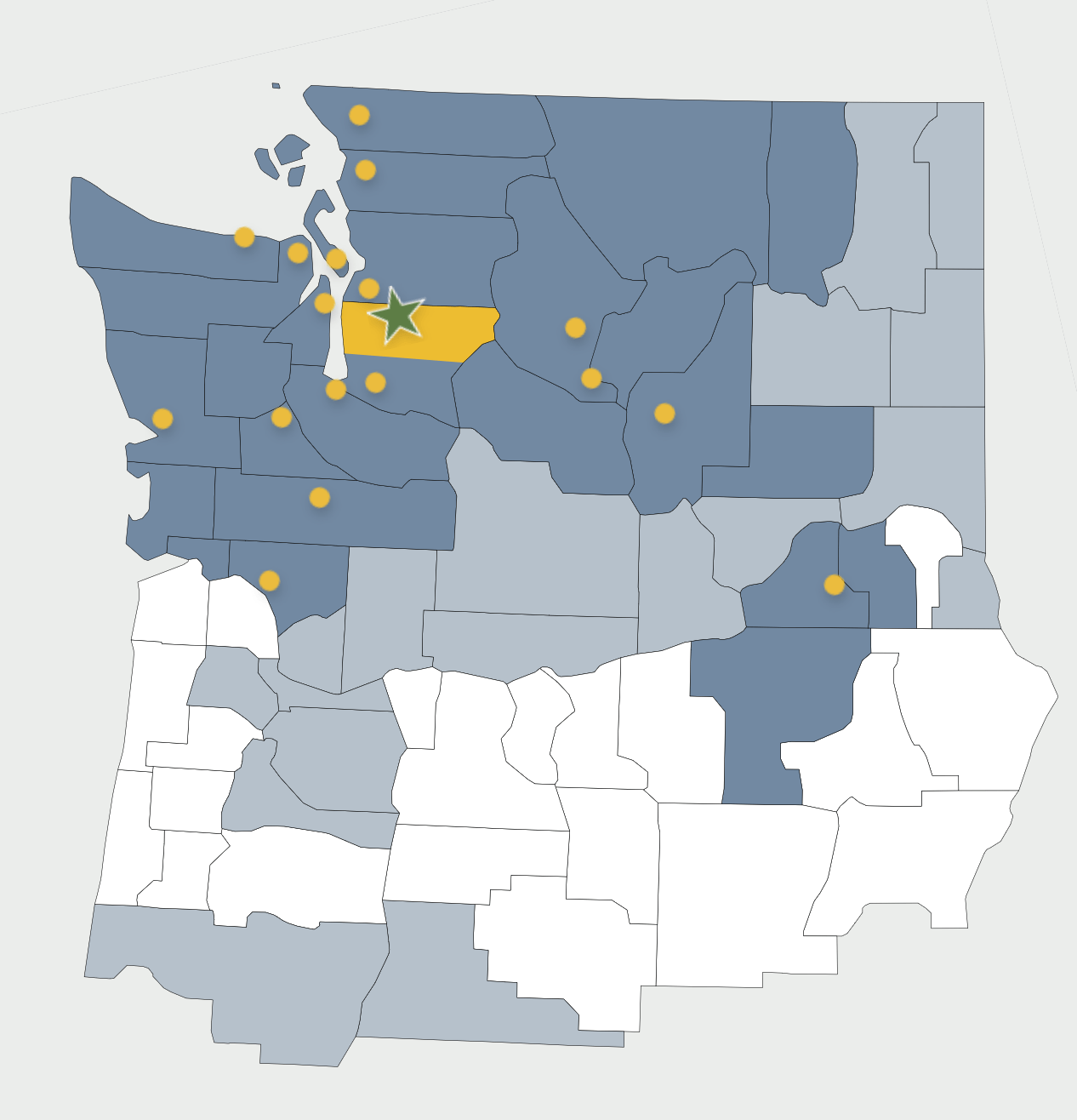

I recently searched for homes in Bellevue, Kirkland, and Renton. The price range was between $350,000 and $650,000. I found 26 properties. 19 out of those 26 had been on the market for 30 days or more––some even more than 80 days. 14 homes out of those 26 listings had the asking price reduced.

This phenomenon is indicative of two key factors. First, the sellers have not yet tuned into the realities of the greater Seattle area’s current real estate housing market. It also shows that the listing brokers are either behind this curve or cannot have tough conversations with the home sellers and guide them to the asking price appropriate for the current real estate housing market.

The new realities are not limited to entry-level homes. Houses at every price level are experiencing the same thing. Homes in the $2,000,000+ range are also sitting on the market and have price reductions. Earlier, I mentioned tough conversations between the listing brokers and home sellers–––a price reduction of twenty or thirty thousand dollars on a $3,000,000 property does very little to move it. But then, I digress from the topic at hand.

Where is our real estate housing market headed?

We are at the beginning of the shift. For home buyers, being able to negotiate and get the house inspected before you make an offer is becoming a thing again. But the price adjustments still have a ways to go.

If you are a buyer in the one-million-plus price range, I recommend waiting for a little. Let’s see what the Fed does at its next meeting. If you are a buyer in the seven or eight hundred thousand or less price range, you may find good opportunities right now. Hire a seasoned and savvy broker who understands the current market’s complexities and how to navigate these challenges.

I will devote my next two blog posts to buyers and sellers and what steps they can take to benefit from the current real estate housing market.