How Ability to Repay is Calculated

I wrote this blog many years ago. While there has been some improvement in simplifying the information that consumers get to better understand the process, there continues to be confusion about how lenders make their decisions. I felt it would be useful to repost it.

Lenders take two critical factors into account when considering an application for a mortgage loan. They evaluate the borrower and the property. When evaluating a borrower, lenders want to know about their:

- Ability to repay

- Track record of repayment of their other financial obligations.

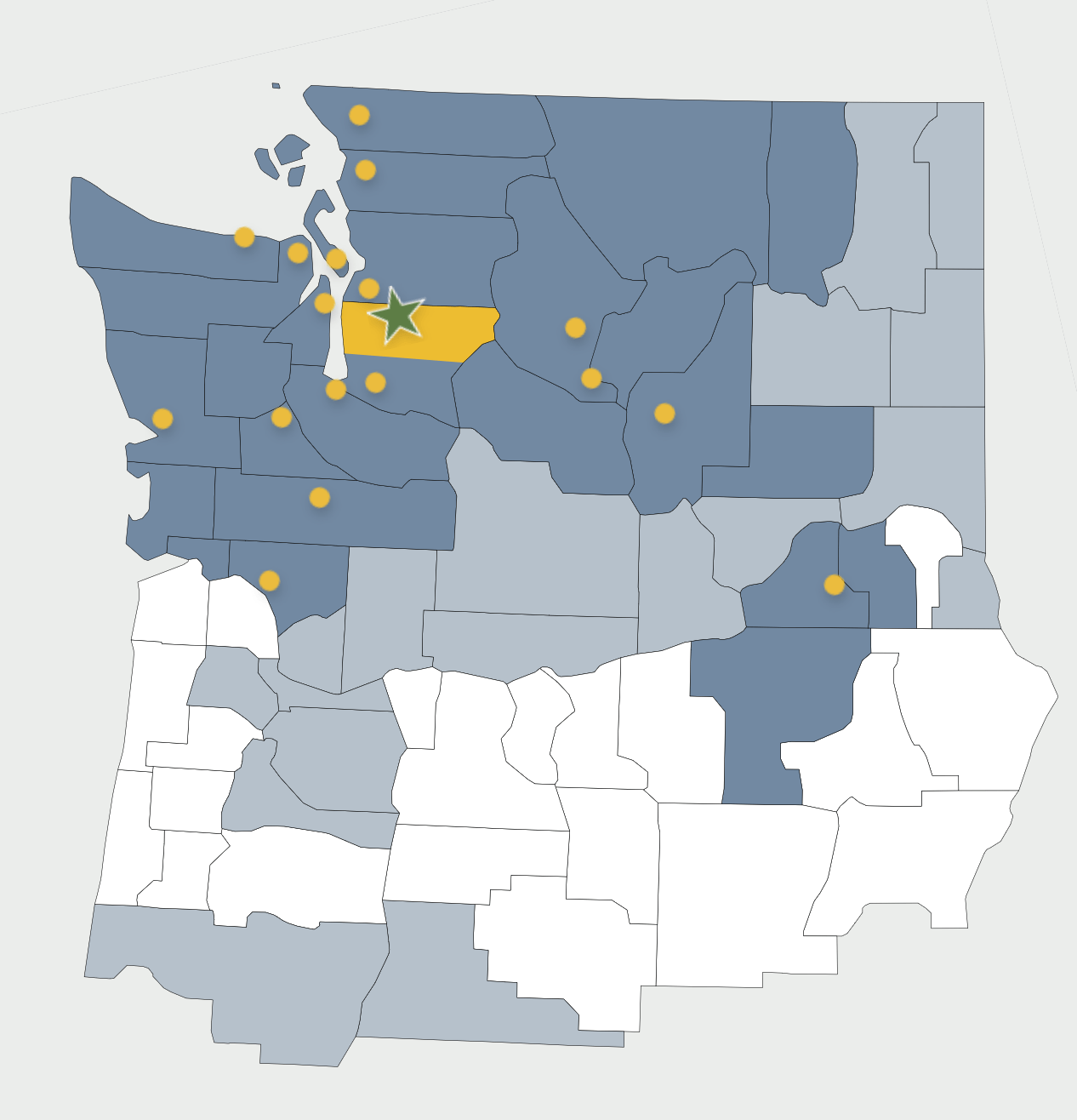

The ability to repay is determined by evaluating the amount and source of their earned income. Supporting documentation is essential. Employed borrowers must provide income documentation for the past two years. This two-year requirement applies to self-employed borrowers as well. For employed borrowers who have a W2, the most recent and highest incomer is used. For self-employed borrowers, an average of the previous two years’ income is used to establish the income that qualifies under the rules. These rules apply if you are buying a home in Redmond, Sammamish, or anywhere else in the country.

How Track Record is Calculated

A borrower’s track record is determined by looking at the complete history of every payment he or she has ever made for each reportable financial obligation, for the last seven years. A borrower’s credit score represents this track record.

A credit score is a number that provides specific information about his/her repayment history. The Credit Scoring system uses a number developed by assigning numerical values to various aspects of borrowing and the repayment history of these loans. It also takes into account the history of seeking additional credit and how the credit was used.

Here are some key factors you can share with your clients:

- Making payments on time is critical.

- Delayed, or even missed payments have a substantial negative impact.

- The nature and purpose of the credit obtained plays a part.

- How much of the credit granted you use is also a factor.

- How long your accounts have been in good standing is a factor.

Here’s how the different credit reporting agencies calculate your client’s Credit Score.

- 35% – repayment history.

- 30% – credit utilization history.

- 15% – length of involvement in borrowing.

- 10% – types of credit used.

- 10% – frequency of attempts made to obtain credit.

Repayment history is a major player in whether your client will have a high enough credit score to secure better interest rates. You can also see that how your client has used credit in the past will affect his or her score significantly.

It is essential to understand the role your credit score plays in the lender’s decision when considering applying for a loan. A lower-than-permitted credit score factor is more important than the ability to repay.