Buying a home

The current sentiment that the real estate market is crazy is the aptest description. Buying a home in 2021 has become a very different experience. It does not serve homebuyers very well, who feel helpless as the market demands compel them to give up their legal protections. There is no way to predict when the market conditions might improve.

Equip yourself with crucial information when buying a home

I started to write this blogpost in 2018. Halfway through the draft, I realized this subject required a great deal more information than a six or seven hundred words article. I ended up writing a book on the topic, Buy Your Next Home With Confidence – you can get it on Amazon. I know. It may look like shameless self-promotion, not really. If you are thinking about buying a home, this book will help you substantially. You may even save tens of thousands of dollars and avoid a whole lot of aggravation.

Get the right professional in your corner

A harsh reality is that there aren’t enough homes for sale—this basic principle of supply and demand is squeezing homebuyers from all directions. Oh, and we are still in a 100-year pandemic.

Buying a home is a complex and stressful process at the best of times. It has become a nightmare in this market. There are numerous offers for every home that comes on the market. People who are buying a home are expected to pay tens of thousands more than the asking price and are compelled to waive most of the rights afforded to them. Sadly, inept, inexperienced, and poorly trained real estate brokers feel overwhelmed and out of their depth by this competitive environment. More than ever before, you need a seasoned and knowledgeable pro in your corner if you are considering buying a home.

Real Estate transactions involve several different professionals

Every single real estate transaction involves numerous individuals and organizations who perform specific functions. Each is duly licensed and must follow specific guidelines. However, the ultimate responsibility of protecting her or his interest rests on the shoulders of the homebuyer.

It would be best if you did not throw caution to the wind.

There is no denying that homes are hard to find. Because there are many more buyers than homes for sale, there are several offers for the same home, which pushes the prices higher. If it were just the price, that’d be one thing. Now buyers are waiving their legal rights and abandoning due diligence, thus exposing themselves to severe losses.

For most people, buying a home is the most significant financial undertaking and requires diligence. A misstep here can be a catastrophe. It would be best if you protect yourself from potentially grave consequences.

Protections for homebuyers

Washington State has specific rules and laws that protect homebuyer’s interests. For example, when buying a home, you have the right to have a licensed home inspector inspect the home. You can do as many additional inspections as the home inspector recommends. If you are not satisfied with the inspection, you can walk away from the sale without any obligation and get your earnest money refunded.

The financing contingency is the second most essential protection enjoyed by those who are buying a home. You get to walk away from the transaction if you were unable to obtain financing.

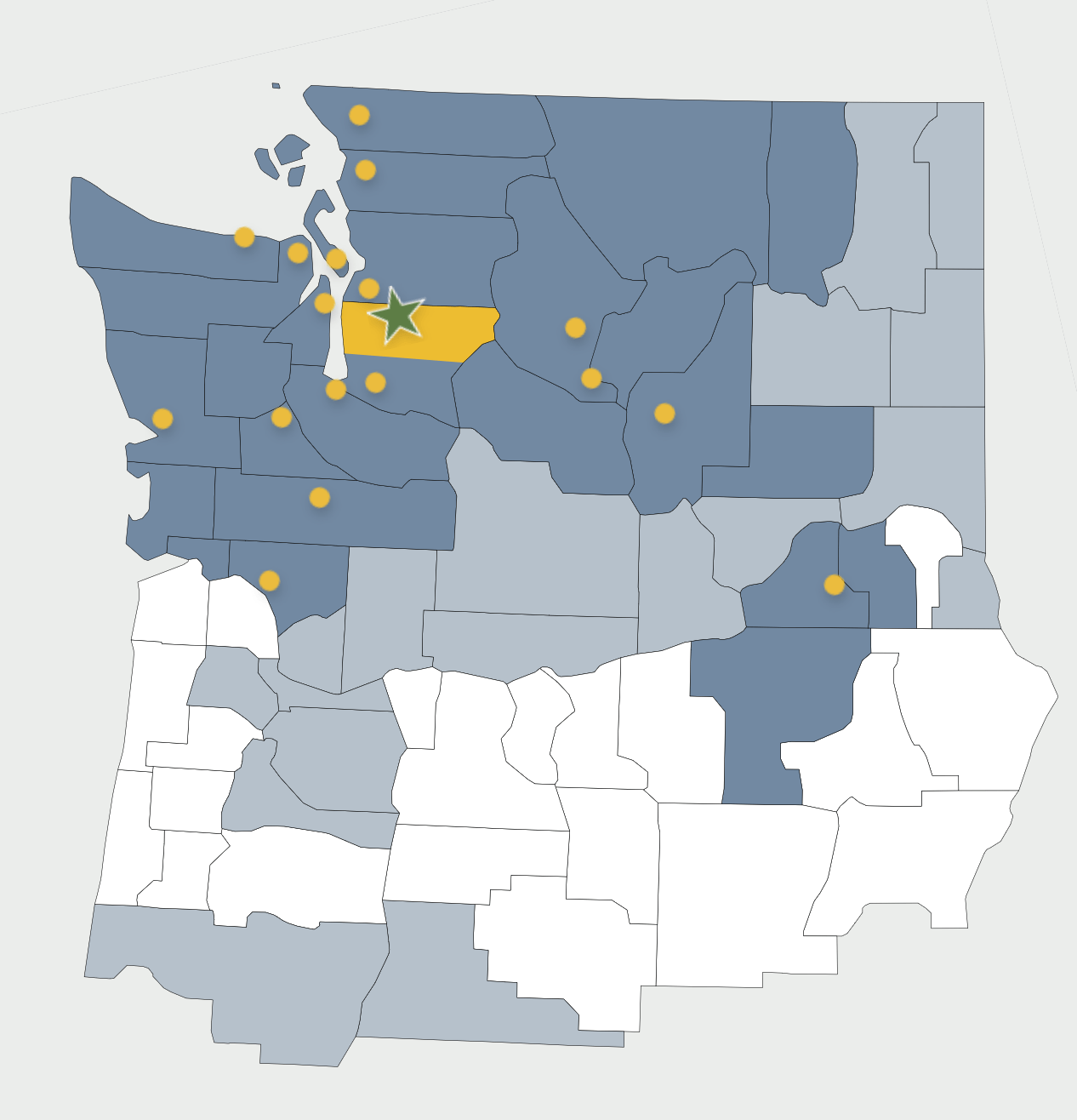

In my more than twenty years of serving my clients in the Greater Seattle area, I have never come across a justified situation that required my clients to throw caution to the wind and surrender all or even one of their legal protections when buying a home.

Because Washington State provides these protections to those buying a home, our courts view the caveat emptor; buyers be aware principle as an important one. They look unfavorably at buyers who seek remedies after surrendering their legal protections.

As in other professions, knowledge-base and skill level varies significantly amongst real estate brokers. Many brokers are ill-equipped to function optimally in the nuanced and complex market that currently exists in Washington. Their minimal training and amateurish negotiation skills do not help either. Most are too eager to get a sale rather than fulfill their legal obligation to protect their client’s interests. This phenomenon makes it even more critical to ensure that you have a seasoned and knowledgeable real estate broker, with top-notch negotiation skills, in your corner when buying a home.

Some home buying tips

It can be challenging to locate and then acquire a home that meets most of your needs and desires for a price that makes sense. Information based on reliable research combined with expert advice leads to exceptional decisions for home buying. Plan for your buying a home adventure in the same way that you might plan for any other experience:

-

- Plan ahead. I suggest three to six months lead time.

- Get your financing in place. That means having an underwriter’s approval. A pre-approval letter will not suffice.

- Do your home buying market research focused on where you want to live.

- Act decisively when you identify a home for sale that meets your needs and desires.

- Ask challenging questions, insist on clear explanations. Make methodical and cautious decisions.

To better understand how to prepare for your home buying experience, and to learn about our 9-point buying system, please visit our buyer services page or get a copy of my book from Amazon, Buy Your Next Home With Confidence.

Your Real Estate Broker

Your real estate broker must provide you vital information and not just warm and fuzzy conversations. She or he must have extensive knowledge of the process and be able to craft a winning offer. She or he must also possess outstanding negotiation skills to fight it out when your offer runs into twenty competing bids. It is equally important that your real estate broker provides you critical decision-making support.

Your real estate broker can often make or break your home buying experience. She or he can be the difference between you being able to buy a house prudently, with most if not all of your legal protections in place, or end up with a home that you acquired blindly, overpaying for it, and after surrendering your legal protections.