Whether it is a buyer’s market or seller’s market, if you want to buy a home, you must know and follow some rules. Following rules is not always that simple yet not much difficult if you tried to do it! So, let’s dig in to know the must-follow rules before buying a home.

As in the previous blog five things to keep in mind when selling your house, here is another blog to explain a rule or formula for homebuyers. This rule helps to avoid stress and worries, which is the rule of 30/30/3. It can be followed by anyone to buy a home within the budget.

30/30/3 Rule for Buying a Home

This 30/30/3 rule is about three major things that are necessary to check and follow before buying a home.

1. Spend 30% of your gross income on a monthly mortgage

Experts advised that one must not spend more than 30% of their monthly gross income on a monthly mortgage. But many people would be enticed to go above 30% as long as mortgage rates continue to fall.

If you maintain your expenditure as a percentage of gross income fixed, you can spend more on your home when rates are lower. But when you break this rule to purchase an even more expensive home. Of course, the full risk becomes apparent.

For example, if you pay your mortgage with 40%-50% of your $50,000 monthly gross income, you still have $25,000 to $30,000 in gross income. However, if you spend 40% of your $5,000 monthly salary, you’ll have significantly less money left-over to cover all your necessities. So spending less is sometimes better and even safer than risking your monthly income.

2. Have cash of 30% of home value on hand ready

Have at least 30% of the home value set aside in cash or low-risk assets before buying a home. It includes 20% for a down payment (to get the best mortgage rate and avoid paying private mortgage insurance) and 10% for a healthy cash buffer.

It may seem excessive, especially since some programs only require a minimal down payment. On the other hand, it’s preferable to have a better financial cushion when there is a lot of uncertainty.

If planning to buy a home in the next few months, it would be great to have at least 20% of your home value as cash. So, there won’t be any issues with the down payment, and you can reduce your overall mortgage rate too.

3. The home value must not be more than 3x of your yearly gross income

This is a quick method of searching for buying a home within your budget. Even with a high down payment, it considers down payment percentages and keeps you from going overboard that is more than you afford. If you make $50,000 a year, you can comfortably buy a home that costs up to $150,000. On the other hand, if your household income is in the top 1% at $500,000, you can afford up to $1,500,000.

Moreover, housing affordability has increased same as the collapse in mortgage rates. Therefore, the home value could be increased by up to five times your annual household income by deviating from the final norm.

Just keep in mind that an income five times more entails higher property taxes and upkeep costs in addition to increased total debt.

Other than these three main essential things, there are a few more things that need to be considered while buying a home. Buying a home process involves many aspects, and the main one is discipline. Discipline is not only a must in the Real Estate Industry, but you must also have it to be successful in any industry!

Despite all the advantages of real estate investing, it’s wise to refrain from going overboard with your cash. Keep in mind that you will also need to pay for homeowner’s insurance, property taxes, and maintenance costs in addition to your mortgage.

First, buy a house that suits your lifestyle. It would be great if it’s worth increasing. If not, it makes little difference since you spent all those years making beautiful memories in your house.

In A Nutshell

To make a smart financial decision about buying a home, focus on these major points before making an offer.

Also, ensure you are ready to buy the house and accept it as your own. Then, follow these simple ways to buy a home within your budget before moving out from your place.

At the end of the day, there are no guarantees in life. So, at least plan your monthly mortgage payment and housing budget perfectly to save some up.

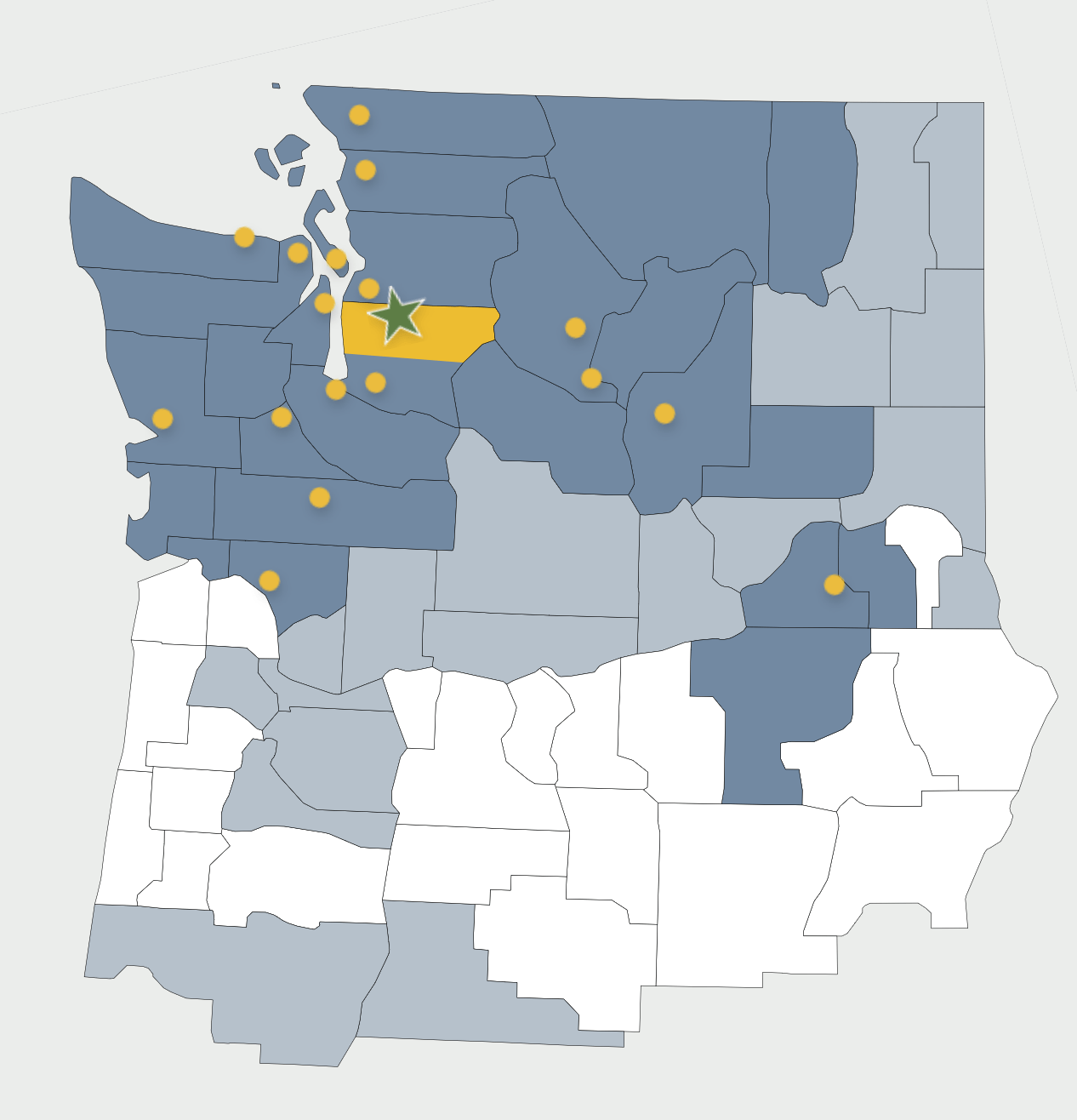

We can help if you require a real estate agent in Washington and the surrounding areas of Monroe, Redmond, Bellevue, Kirkland, and Sammamish. Contact us now!