Stay Fully Informed. Knowledge is power.

In Real Estate, knowledge helps you make the right decisions and avoid costly mistakes!

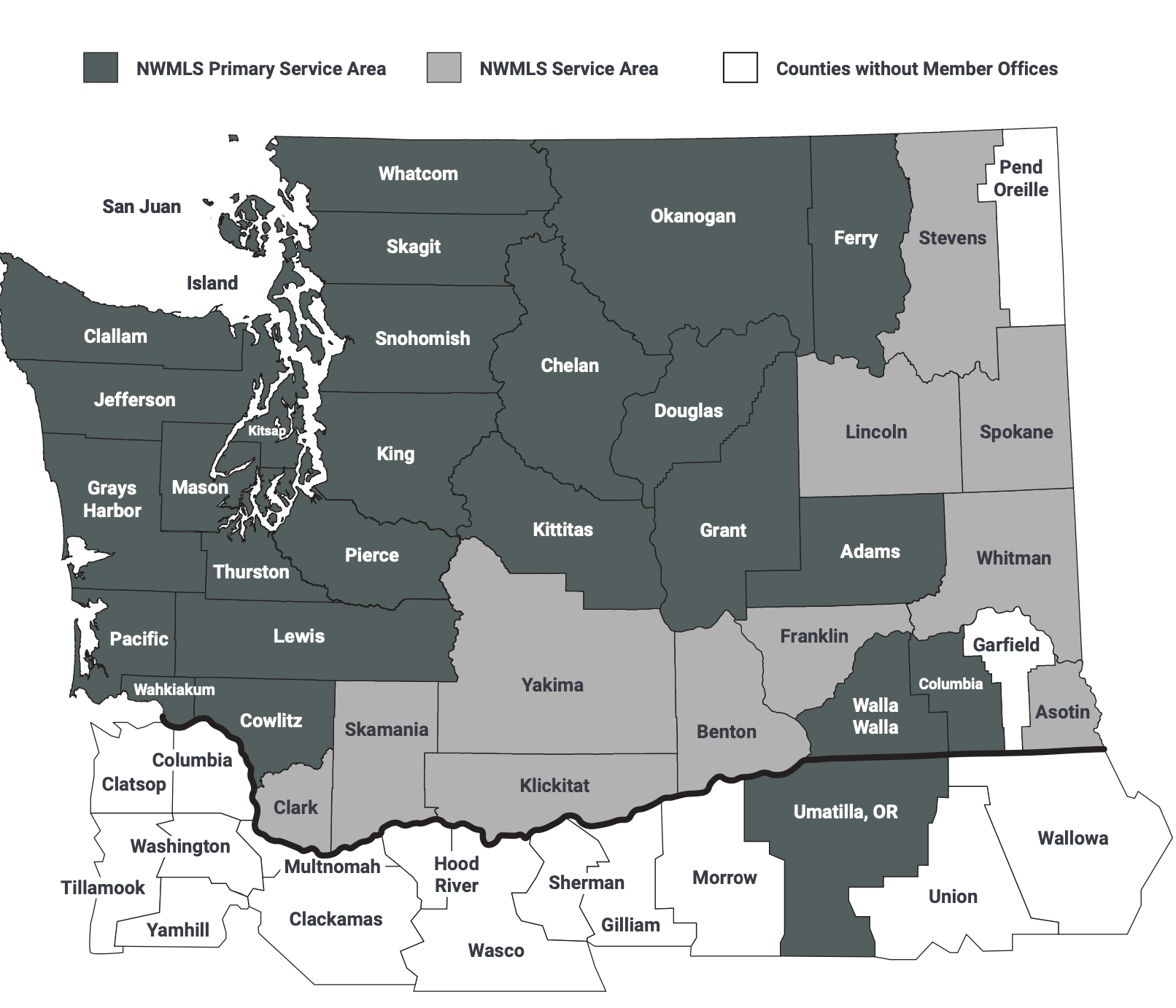

The stats for August 2024 continue to point to an upward trend. Northwest MLS key metrics for August 2024 activity, including new and active listings and pending and closed sales, indicate that the housing market is loosening up a little. Mortgage rates fell to low 6s (6.27% last week), at their lowest level since March 2023. August 2024 reflected year-over-year increases in the number of active listings, new listings and pending sales. At the same time, the number of closed sales year-over-year was virtually unchanged, and median home prices rose in 20 of the 26 counties covered by NWMLS.

Highlights:

Active Listings: The total number of properties listed for sale increased by 34.1%, with 15,453 active listings on the market at the end of August 2024, compared to 11,525 at the end of August 2023.

The number of homes for sale increased throughout Washington, with 25 out of 26 counties seeing a double-digit year-over-year increase. The five counties with the highest increases in active inventory for sale were Douglas (+65.1%), Mason (+49.2%), Lewis (+49%), Pacific (+48%) and Pierce (+43%).

Closed Sales: This number remained relatively unchanged year over year. 15 out of 26 counties saw an increase in the number of closed sales, while 11 saw a decrease.

Median Sale Price: The median price for residential homes and condominiums sold in August 2024 was $645,000, an increase of 4.9% from August 2023 ($615,000).

The three counties with the highest median sale prices were San Juan ($905,000), King ($860,000) and Snohomish ($762,500), and the three counties with the lowest median sale prices were Ferry ($282,500), Adams ($307,475) and Pacific ($332,500).

At the beginning of 2024, I wrote that Unjustified optimism remains about a persistent decline in mortgage interest rates. I expect us to experience a see-saw of lending rates throughout 2024, and then they will settle somewhere between 5% and 6%. That seesaw has been in place in recent months. The rates were closer to 6% than they have been in a while. I believe it may be another year before the mortgage interest rates settle in the low 5s. We must not forget that too many factors, the least of which are not geo-political conflicts, could significantly alter these predictions.

I continue to believe that current homeowners who are aptly not eager to sell their homes because they have mortgages well under 4%, some even less than 3%, will remain a significant factor in inventory shortage for some time. However, there are some indications that things are easing up a little in that regard.